Insurance For Towing Companies

8:30am - 5:00pm Mon-Fri

Will Reply in 15min*

Top 3 Recommended Policies

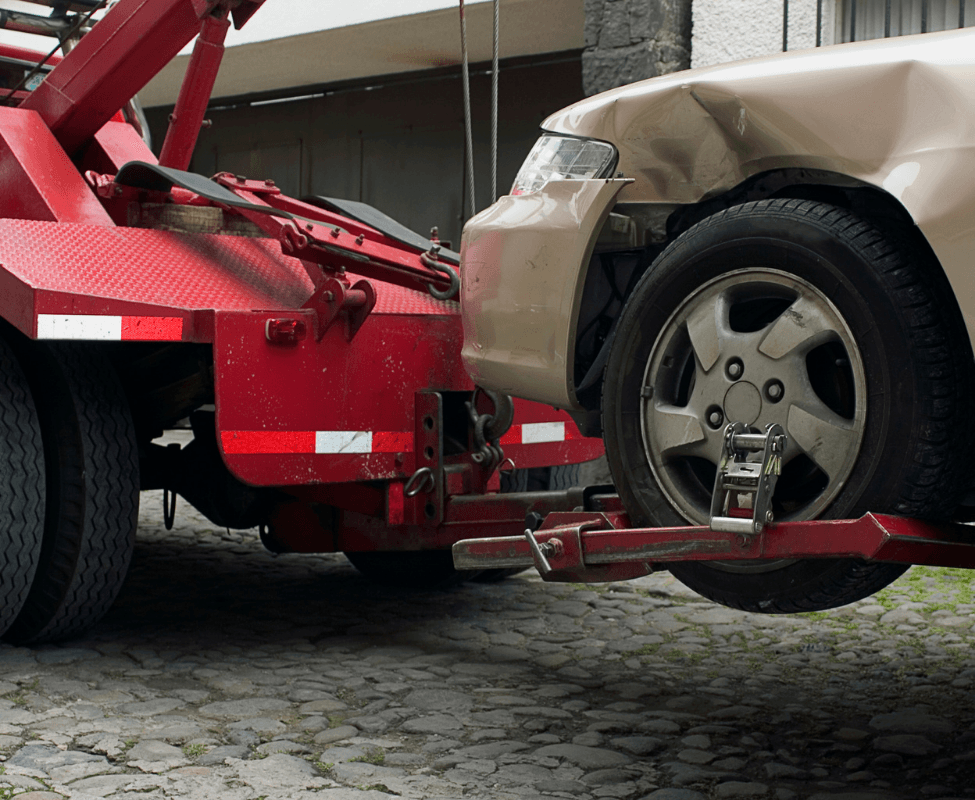

What Insurance Is Needed for Towing Companies?

Towing services are essential to the well-being of our communities. Tow truck insurance is a must-have whether you operate a tow truck business or are thinking about starting one.

A tow truck company’s insurance requirements can vary greatly from one to the other. With the help of an independent insurance broker, you can tailor your insurance coverage to suit your specific needs and budget. But what insurance is needed for towing companies? Let’s find out.

Over 180+ commercial clients covered

100% customer satisfaction guaranteed

Over 10 years of commercial insurance experience

Insurance Policies to Consider For Towing Companies

Tow Truck Insurance Protection Is Necessary

Tow truck insurance is needed by various firms, including those in the towing industry. Various businesses greatly benefit from this vital protection. These businesses include:

- Companies that offer roadside assistance

- Body shops for cars

- Mechanics

- In the business of auctions

Any organization that utilizes or provides towing services needs tow truck insurance protection. There are various sorts of insurance that might come in handy for different departments in different situations.

Why Is Towing Insurance Necessary for a Towing Company?

The majority of states require tow trucks and other commercial vehicles to have commercial auto insurance. Depending on the terms of a lease or a contract with a client, business owners might also need general liability insurance.

Even if you don’t have to, it’s a good idea to have commercial insurance. It can be used to cover unforeseen costs that could hurt your towing business, such as expensive repairs, medical bills, or a lawsuit.

The following situations will help you understand the need for insurance for a towing company:

1. Because of anxiety over the condition of their vehicle, someone too close to the loading area can get their hand caught between the vehicle and other equipment. If they have General Liability insurance, it will cover the medical expenses after the accident.

2. During a normal pick-up, if your staff forgets to affix a strap properly securing the vehicle that is being towed, the truck and car can separate, resulting in significant damage to both vehicles. In this case, General Liability insurance will cover damage to the customer’s vehicle.

3. Suppose you mistakenly back the customer’s vehicle into a door or a gate when dropping off a vehicle at an auto shop. In that case, the damage to the door/gate and the vehicle will be covered by General Liability insurance.

Different Types of Insurance Coverage for Towing Companies

Vehicle recovery businesses have a wide range of insurance options. You need to research and find the set of policies that best suit your needs. It would be best to find the correct combination of coverage types and limits. However, please don’t pay for more coverage than you really need and then discover that it’s not there until it’s too late.

Working with an independent insurance agent can help you acquire the coverage you need without piling on unnecessary forms of coverage. Your tow truck firm will need the following kinds of insurance policies:

Business Owner's Policy

You need to remember that you are running a business as a whole. The requirement for insurance protection is something your organization has in common with many others. Firm owners plan Business Owner Policies (BOPs) to provide an additional layer of protection for the business, which includes coverage for the following things:

Property Insurance

It includes buildings, office equipment, furnishings, and the inventory of supplies and equipment, including trucks and vehicles.

Business Interruption Insurance

Suppose your business is destroyed in a way that necessitates you to stop operations while repairs are completed. In that case, this insurance will cover the costs of moving to a new location and the loss of income.

Liability Insurance to Cover

The BOP provides basic liability protections as a starting point for general liability coverage. Tow truck companies, in particular, should purchase additional general liability insurance and other types of liability insurance to the costs of the lawsuit.

A towing company requires the set of insurance policies mentioned above at any cost. However, other options are also available if an emergency arises.

Options for Liability Insurance Protection

Your company’s assets are safeguarded by liability insurance against various risks, including damage to third parties while in your custody or transit. If you own a tow truck business, you might need the following insurance policies:

- Liability insurance for a tow truck

- Payment for health care

- Insurance for physical damage

- Insurance for garage services

- Insurance for on-hook towing

- Excessive responsibility

- Umbrella liability

- Cyber Liability

- EPLI

Liability insurance is essential for a towing service. It is not only your liability insurance that protects you from being held liable for damages. If you’re sued, it can also assist cover the costs of defending your company, drivers, and so on.

Workers’ Compensation Insurance

If a towing company employs workers, workers’ compensation insurance is another insurance that it must have. Workers’ compensation insurance protects your employees if they get hurt, fall ill, or die during their employment at your company.

Every time a tow truck driver gets behind the wheel, they risk being seriously injured or even killed. As a result, drivers can rest assured that their medical requirements will be taken care of by the company and that a portion of their income will be paid for if an unexpected illness or injury prevents them from working.

General Liability Insurance Premiums

To cover $1 million in general liability, the average American tow truck company insurance costs between $450 and $1,500 annually. Some variables will determine the cost of your insurance. These include:

- Location

- Maximum number of workers involved

Restriction on the sum of all values

Businesses can save money by acquiring general liability insurance as part of the business owner’s policy (BOP). Business interruption and property insurance are included in a BOP, a complete insurance plan. Therefore, every towing company should get BOP.

If you have any more questions about what insurance is needed for towing companies, contact us!

Request a Quote

Speak with a Towing Companies Insurance specialist today!

Get started today!

Whether you are the owner of a towing companies, you will need business insurance policies to protect your business and all those associated with it. We hope that with the four business insurance coverages that we have mentioned above, you will be able to find specialized insurance coverages that have been customized for the needs of your towing companies. It is always better to be proactive instead of reactive.

Prefer to speak with an agent now?