Commercial Umbrella Insurance

Adding an additional layer of security to your current coverage

8:30am - 5:00pm Mon-Fri

Will Reply in 15min*

What Is Commercial Umbrella and What Does It Cover in NM, Utah, and Texas?

Have you ever wondered what an umbrella policy is and how it can affect your business? A commercial umbrella policy can protect your business against death, liability judgments for loss, and injury.

Protecting assets and against potential lawsuits is often the primary reason and motivation for most business owners to purchase umbrella insurance. In addition, it also boosts the coverage limits of an existing umbrella policy. In this article, we will discuss in detail what commercial umbrella insurance is and what it covers.

Over 180+ commercial clients covered

100% customer satisfaction guaranteed

Over 10 years of commercial insurance experience

Commercial Umbrella Insurance Application

Click the button below to receive a custom quote to fit your business' budget and needs.

Commercial Umbrella Insurance Policies in New Mexico, Utah, and Texas

What Is Commercial Umbrella Insurance?

Commercial umbrella insurance provides additional coverage to pay for certain costs that exceed the limits of a liability policy, such as the commercial auto liability, general liability, and other fundamental policies. In simple terms, commercial umbrella insurance provides additional coverage and protects the business from incurring large liability losses. Without commercial umbrella insurance, business owners would have to pay out of their own pockets to cover the cost of liability claims that cost more than the coverage limit. The additional costs can include the following:

- Medical bills

- Judgments and settlements

- Legal costs

- Damage to other people’s property

A commercial umbrella is responsible for paying the dues when the limits on the insured’s business auto, employer’s liability insurance, or general liability have been depleted or reduced. Commercial umbrella insurance has the following fundamental purposes:

- A commercial umbrella helps to provide coverage when the total limits of an underlying policy have been exhausted or reduced by claim payments

- It pays for certain types of losses that are not covered by underlying policies

- It provides extra limits over those contained in the primary coverage

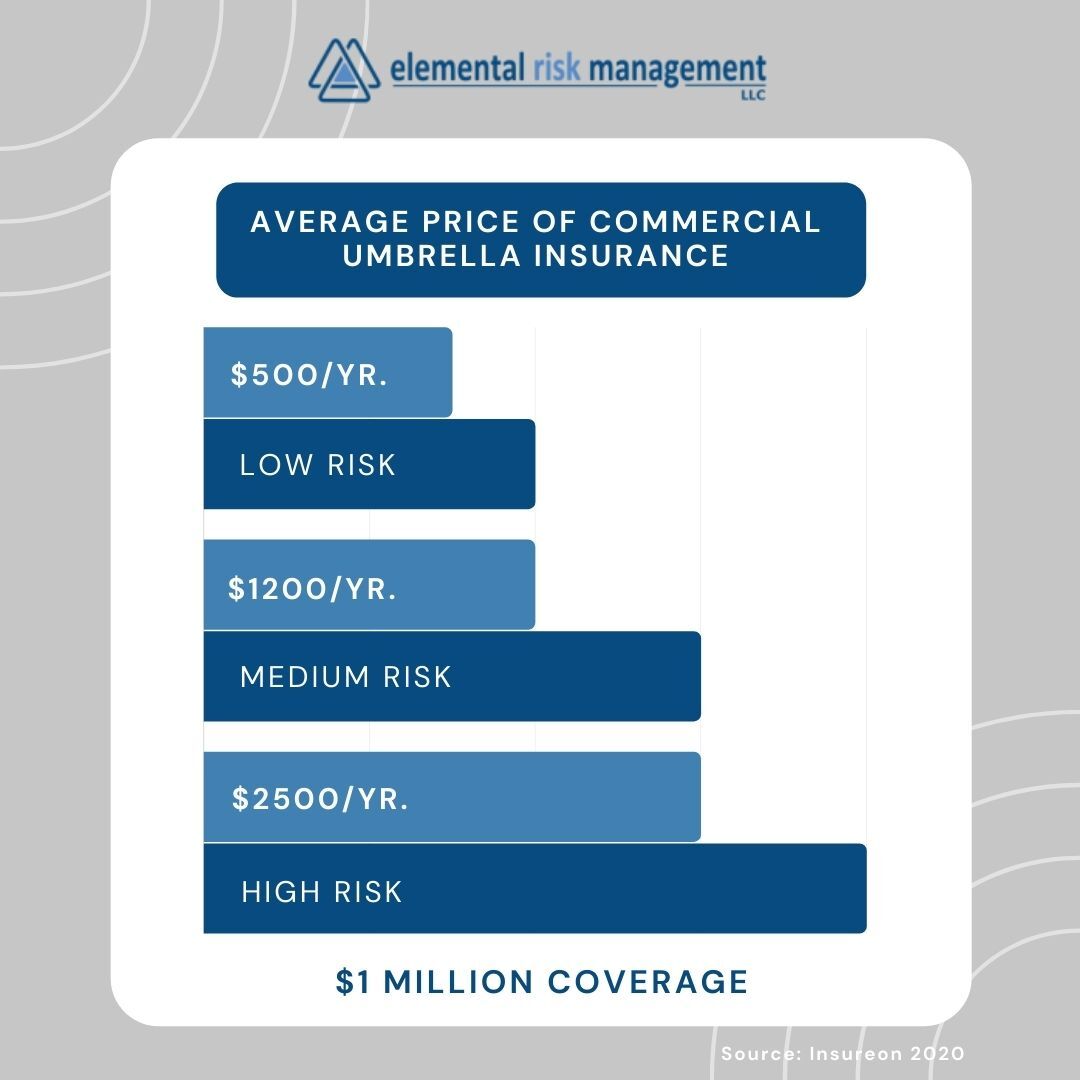

Why Should You Purchase Commercial Umbrella Insurance?

Most businesses purchase commercial umbrella insurance because it provides protection against huge losses that their main policies cannot cover. Even though any business can incur large losses at a certain point, there are certain firms that are more susceptible and prone to catastrophic losses than others. Tree trimmer, construction contractors, or crane operators are a few notable examples.

Some business owners purchase commercial umbrella insurance to achieve the requirements of limits in an agreement. For instance, company A has signed a contract with company B to construct a new playground at a daycare center. The contract requires company A to establish a $4 million per incidence limit for general liability and $4 million per accident for auto liability insurance.

If company A’s limits of auto policies and underlying liability are only $1 million, the company can oblige to the agreement by purchasing an umbrella policy of a $3 million limit. The $3 million limit will be covering the $1 million general and auto liability policies and will ultimately result in a total limit of $4 million.

What Does Commercial Umbrella Insurance Policy Cover?

Commercial umbrella insurance covers the settlements or damages that can come from various claims against a business for personal and advertising, property damage, or bodily injury. It also provides protection to the firm against lawsuits covered by the insurance policy. An umbrella policy will be applicable if the settlement surpasses the limits on the primary insurance or if the claim covered by the policy generates damages.

Be aware that commercial umbrella insurance provides extra protection in addition to the general liability policy. So if you don’t have general liability insurance, you will not be eligible for commercial umbrella insurance.

Commercial umbrella insurance is not only meant for large businesses. In today’s world, many types of minor accidents or actions can cause huge liability judgments, such as a delivery man driving a company vehicle causing an accident that substantially injures another driver. Thus, without a commercial umbrella, your business can easily find itself on the verge of incurring huge additional payments above the limits of your primary policy.

Precautions to Take While Buying Umbrella Insurance

There are certain things you should be aware of while searching for umbrella insurance. First, most of the commercial umbrella insurance policies are written by insurers on forms, so the policies can greatly vary. Some insurers claim their policies as umbrella when it is merely an excess policy. According to IRMI, an umbrella policy provides both broader coverage and excess limits than the primary insurance. In contrast, an excess policy offers additional limits but no extra coverage than the underlying insurance.

Secondly, some umbrella policies include self-insured retention (SIR), which is a specified amount to be paid by your firm before the umbrella pays any amount. This applies to all of the claims that are covered under the umbrella but not in the underlying policy.

Finally, your primary policies and your umbrella policy should have the same expiration and inception dates. If your umbrella does not run concurrently with your primary policies, it can cause coverage gaps.

Who Should Purchase Commercial Umbrella Insurance?

Ideally, if your business involves a lot of interaction with clients and other stakeholders in person, your liability will be higher. The risks can be increased if your employees have to deal with dangerous equipment or heavy machinery. If you think that the cost of your claims exceeds your liability limits, purchasing commercial umbrella insurance is a good choice. The coverage can help if your firm:

- Allows the public to visit during business operations

- Frequently interacts with customers

- Works on someone else’s property

Some companies incur higher expenses that cannot be covered by the current insurance policy. Commercial umbrella insurance provides both extra limits and wider coverage for businesses. This type of coverage can easily protect your business from reputational damage, liability claim, customer injury, product liability, and vehicular accidents. It also serves as a backup policy in case someone files a lawsuit against the business that exceeds the amount of your underlying policy.

Request a Quote

Get a commercial umbrella quote today!

Get started today!

Our commercial umbrella insurance plans provide additional coverage to pay for certain costs that exceed the limits of a liability policy, such as the commercial auto liability, general liability, and other fundamental policies.

Prefer to speak with an agent now?