Professional Liability Insurance

Protection from income and financial loss in case of an alleged charge

8:30am - 5:00pm Mon-Fri

Will Reply in 15min*

What does Professional Liability Insurance Cover in New Mexico, Utah and Texas?

Professionals that have their private practices, such as lawyers, physicians, and accountants, are often advised to get professional liability insurance coverage.

This kind of coverage is aimed at giving them protection from income loss and financial loss in case a patient or client files a lawsuit against their private practice and professional on alleged charges of malpractice, negligence, misconduct, or misinterpretation. It covers the cost of legal fees and any out-of-court settlements or medical expenses that must be paid to the applicant or affected patient/client.

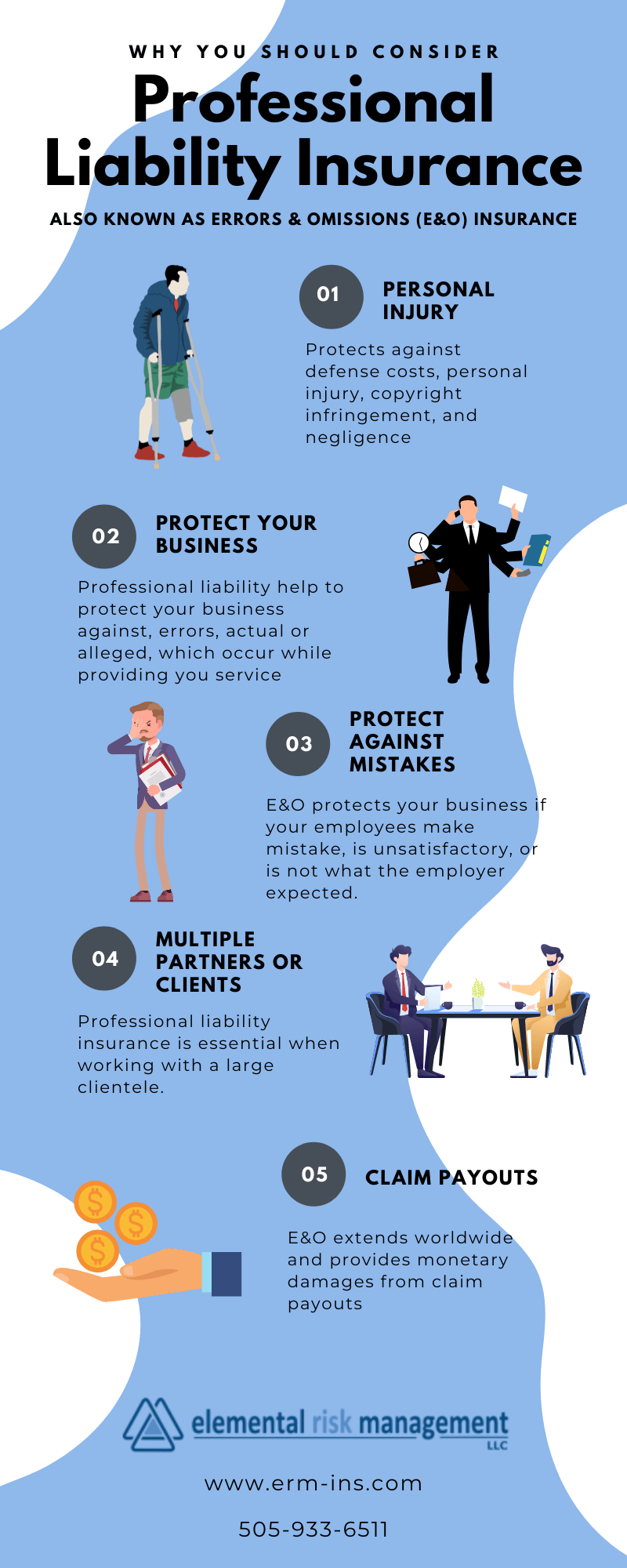

Professional liability insurance is also known as Errors and Omissions (E&O) insurance. Error and Omissions insurance is also applicable to businesses that have been charged by their customers or clients for making false claims about their products or services.

For example, if the manufacturer of a skin tightening serum claimed that the serum is animal cruelty-free, but a customer claims that the product is being actively tested on rabbits before being released into the market, then the professional liability insurance will cover all the costs of this lawsuit and also help the company make up for the lost income while the court case is being pursued.

Another instance where the professional liability insurance could greatly safeguard your private practice in New Mexico is that if a patient claims that his or her physician neglected to offer post-surgery aftercare because of which the patient has now developed serious infections and must undergo another surgery to heal it.

In such a case, the professional liability claims will pay for the lawyer’s fee, additional legal expenses such as paperwork, and in case the hospital has to be temporarily shut down, the insurance company will cover all the costs from the closure, such as salaries, operational expenses, etc.

It is to be noted that if a patient or client or a peer pressure group files a lawsuit against a professional, it could go on for months because the professional’s first priority would be to save his or her license from getting canceled.

However, in some cases, professionals have resorted to out-of-court settlements by paying compensation to the affected parties. Monetary compensations are also covered by professional liability insurance claims.

Over 180+ commercial clients covered

100% customer satisfaction guaranteed

Over 10 years of commercial insurance experience

Benefits of Professional Liability Insurance

Easy access to legal advisors

The professional liability insurance coverage also includes easy access to legal advisors. Not only will you be paid by the insurance company to pay the attorney for pursuing the case on your behalf, but you can also hire the lawyer suggested by the insurance company, who without a doubt would have a good track record, to save yourself from the hassle and unnecessary worrying.

The experienced attorney provided by the insurance company will immediately launch a defense and represent you at the court proceedings.

Protects the company for financial losses

There is no doubt in the fact that unexpected lawsuits and the media attention that follows can tarnish a company or professional’s reputation and leave them completely drained of their financial resources. Not only will the individual have to pay for all the legal costs, including the lawyer’s fee to defend him or herself at the court, but he or she may also lose income for months because the customers, patients, or clients will now be hesitant to go to a professional who has an alleged history of malpractice, misconduct, negligence or misinterpretation.

This can be made worse if the outcome was the death of a patient, as in such cases, medical licenses are canceled. During this time of turmoil, the professional liability claims will provide financial support to the professional, and he or she will receive an additional amount on a monthly basis to meet all the business-related expenses such as paying the salaries, operational costs, and rent (if applicable).

Preservation of assets

Even if you lose your case and are required to pay the applicant a large sum of money in damages, the professional liability insurance will work like your safety net to fall back on.

Since the insurance company will bear all the costs of your legal expense, damages, or out-of-court settlements, you will still have your savings, income, and assets as the launching pad to restart your business and pick up right from where you left off. Having professional liability insurance coverage will give you peace of mind and secure your future.

Request a Quote

Get a professional liability quote online today!

Get started today!

We are your specialized business partners and make sure that your small business or private practice is always protected from unexpected events that can lead to extreme financial losses.

We understand your unique business needs and our professional liability insurance plans offer coverages that can give you access to legal aid, financial support, and monthly allowances to keep your life and business on track.

We believe in being proactive, and for this very reason, our coverage plans offer you all the benefits of an international standard professional liability insurance service.

Prefer to speak with an agent now?